Capital structure best practices are something that can be used in your favor, if given the appropriate attention. Determining the “optimal” balance of equity and debt will ensure that the firm can maximize its value. “Optimal Capital Structure” involves taking the trade-off between the benefits of higher leverage such as the tax-deductible nature of interest, and the lower costs associated with debt than equity while building equity at the same time. This ratio can be wildly different between different firms, even in the same industry, so as a leader, the optimal capital structure should be determined for your business.

Maximizing your firm’s value:

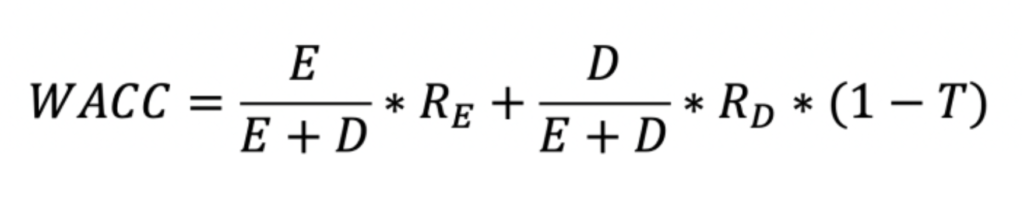

Management should try and target the optimal capital structure that will minimize the firm’s weighted average cost of capital. You can use this WACC calculator to calculate various Weighted Average Cost of Capital scenarios.

E = Equity, D = Debt, rE = Cost of Equity (%), rD = Cost of Debt (%) and t = Nominal Tax Rate

Since passing the Tax Cuts and Jobs Act of 2017, the federal corporate tax rate has been 21%. This rate applies to taxable income, which is a small business’s revenue minus expenses. Using the link to the WACC calculator, try switching the amount of debt and the amount of equity. You’ll notice $4M in equity and $6M in debt gives you a WACC of 9.79%. Whereas, $6M in equity and $4M in debt give you a WACC of 11.53%, all other variables remaining constant. Clearly it is more advantageous to take on more debt than equity in this particular scenario.

Time to analyze your company’s capital structure:

Time to analyze your company’s capital structure:

Have you taken the time to review your finances and determine the optimal capital structure for your business? The first step is to understand the different variables that affect the firm’s costs in respect to capital so that steps can be taken to lower these costs. Then, the above formula can be used to analyze the current capital structure and compare it to other possible debt-to-equity ratios.

We are always happy to assist our clients in determining the optimal capital structure for their business. You can fill out the form on the Homepage , book some time on my calendar, or just give me a call at (843) 790-3661.

Growth funding and working capital structure is my passion. I’ve worked with a wide range of companies over the years from start-up to $30+ million. I’ve helped companies to scale quickly, take on new projects, or capitalize on recent opportunities. Business loans and asset-based facilities from $50k to $10MM.

- Brian Cate